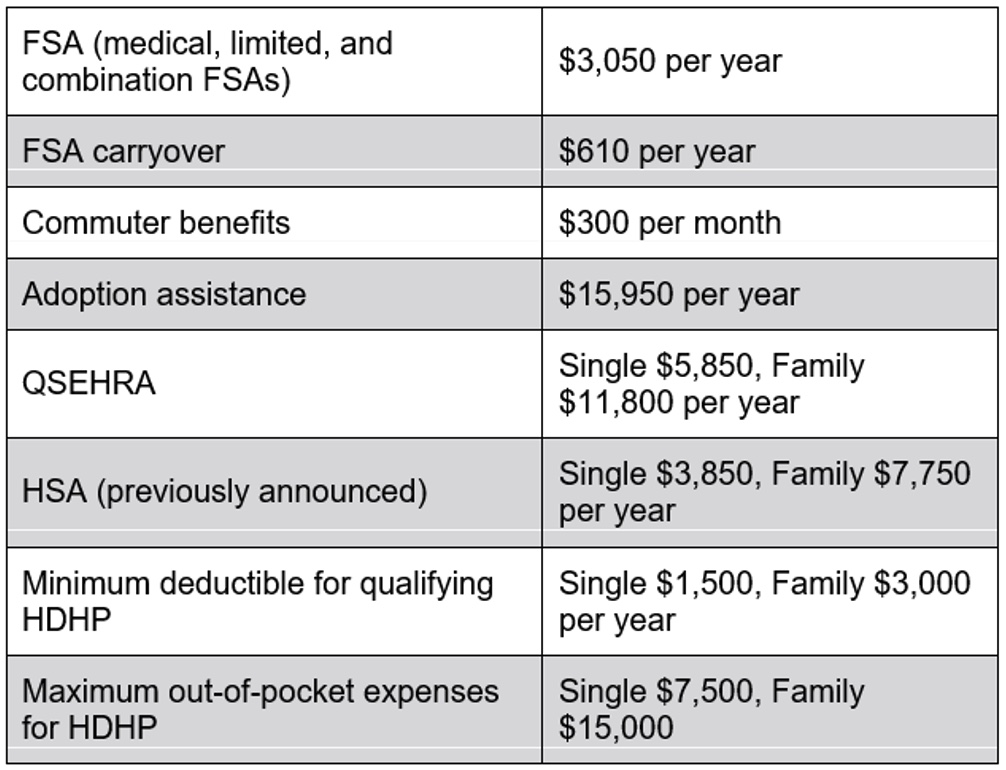

Fsa Contribution Limits 2025 Family Of 6. For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

How do fsa contribution and rollover limits work? Employers have the choice to permit carryovers, and for 2025, the limit is ascending from.

2025 Fsa Contribution Limits Family Tax Gill, For taxable years beginning in 2025, the annual contribution limit for health fsas has increased from $3,050 in 2025 to $3,200.

Family Fsa Contribution Limit 2025 Lorie Jennee, On november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

2025 Irs Fsa Contribution Limits Issi Rhetta, Keep reading for the updated limits in each category.

IRS Announces 2025 Increases to FSA Contribution Limits SEHP News, Employees can now contribute $150 more.

Fsa 2025 Limits Cyndi Valida, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

2025 Fsa Contribution Limits Family Members Heath Koressa, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Dependent Care Fsa Contribution Limit 2025 Calculator Lotty Riannon, Here are the new 2025 limits compared to 2025:

Fsa Limits 2025 Dependent Care Allowance Gwendolyn, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

Max Fsa Contribution 2025 Family Tax Lucie Kimberlyn, The 2025 dependent care fsa contribution.